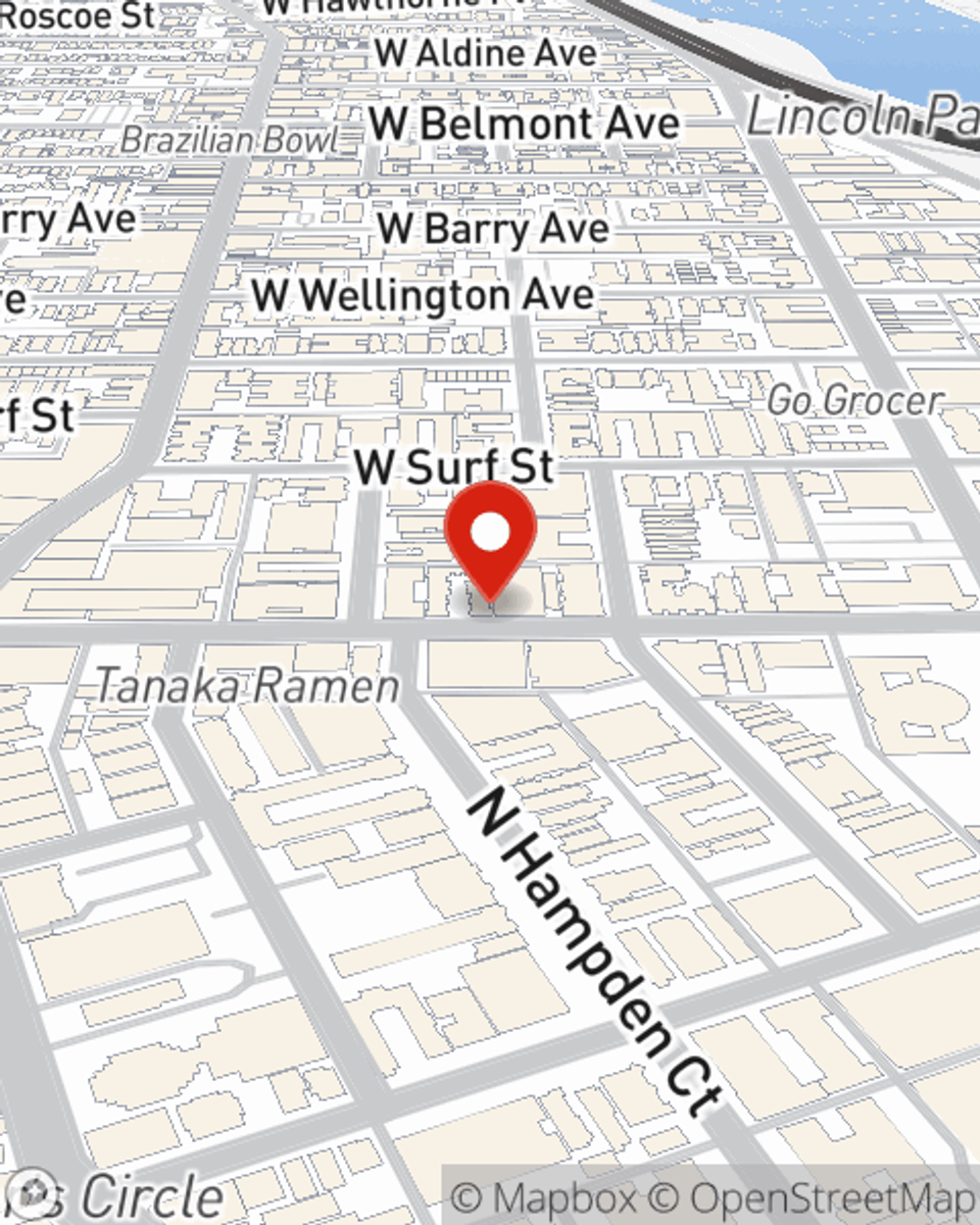

Insurance in and around Chicago

A variety of coverage options to help meet your needs

Customizable coverage based on your needs

Would you like to create a personalized quote?

- Lakeview

- Lincoln Park

- DePaul

- Wrigleyville

- Uptown

- Logan Square

- West Town

- Avondale

- Albany Park

- Lincoln Square

- North Center

- Irving Park

- Portage Park

- Belmont Cragin

- Roscoe Village

- Wicker Park

- Bucktown

- Streeterville

- West Loop

- Loop

- Humbolt Park

- River North

- Gold Coast

- Chicago

Let Us Help You Create A Personal Price Plan®

State Farm understands the need to protect what's important to you and has developed a collection of insurance products with personalized pricing plans to help you save time and money. From vehicle and motorcycle insurance that protects your ride, to your boat, motorhome, RV, and off-road ATV, State Farm has competitive prices and easy claims to help you protect them all. Contact Bill Dillard for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Customizable coverage based on your needs

Protect Your Family, Cars, Home, And Future

But your automobile is just one of the many insurance products where State Farm and Bill Dillard can help. House, condo, or apartment, if it’s your home, it deserves State Farm protection. And for the unexpected. Securing your family’s financial future can be a major concern. Let us ease that burden. With a range of products, personalized pricing plans, and unmatched financial strength, State Farm Life Insurance is a smart choice and a great value.

Simple Insights®

Water in the basement

Water in the basement

Help reduce sewer or drain losses in your basement by checking drainage, reducing backflow and installing a sump pump.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Bill Dillard

State Farm® Insurance AgentSimple Insights®

Water in the basement

Water in the basement

Help reduce sewer or drain losses in your basement by checking drainage, reducing backflow and installing a sump pump.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.